Italy trading is a multifaceted topic that spans across financial markets, international trade, stock exchanges, and modern innovations such as cryptocurrency and AI-based trading platforms. As the third-largest economy in the Eurozone, Italy plays a crucial role in European and global trade — both in terms of goods and financial instruments.

In this guide, we’ll explore the different dimensions of Italy trading landscape, including stock market operations, international trade, regulatory environment, and the rise of digital and AI-powered trading in the country.

Overview of Italy’s Economic and Trading Landscape

Italy has a mixed capitalist economy characterized by a strong industrial base, global exports, and a highly developed service sector. The country is also home to world-renowned brands in fashion, automotive, and manufacturing, which play an essential role in international trade.

Key Economic Facts

- GDP: ~$2 trillion (2024 estimate)

- Main Exports: Machinery, automotive, fashion, food products, pharmaceuticals

- Main Trading Partners: Germany, France, United States, China, Switzerland

Italy’s Stock Market: Borsa Italiana

What Is Borsa Italiana?

Borsa Italiana is Italy’s main stock exchange, based in Milan. It is now part of Euronext, Europe’s largest stock exchange group. Borsa Italiana is the primary hub for equity and derivatives trading in Italy.

Key Market Indices

- FTSE MIB: The benchmark index that includes 40 of the largest and most liquid companies listed on Borsa Italiana.

- FTSE Italia Mid Cap: Focuses on medium-sized companies.

- FTSE AIM Italia: A market for small and high-growth businesses.

Popular Italian Stocks

Some of the most traded companies in Italy include:

- Eni S.p.A. (Energy)

- Intesa Sanpaolo (Banking)

- Ferrari N.V. (Automotive)

- UniCredit (Banking)

- Luxottica (Eyewear/Fashion)

Trading Hours

- Pre-Market: 8:00 – 9:00 AM CET

- Regular Market: 9:00 AM – 5:30 PM CET

- After Hours: 6:00 – 8:30 PM CET

International Trade: Italy as a Global Player

Exports and Imports

Italy is one of the world’s top 10 exporting countries. In 2024, Italy’s total exports exceeded €600 billion, with the following sectors leading the way:

- Automotive: Ferrari, Fiat, Maserati

- Fashion: Gucci, Prada, Armani

- Machinery and Equipment

- Food and Beverages: Olive oil, wine, pasta, cheese

Trade Agreements

Italy, as a member of the European Union, benefits from numerous free trade agreements negotiated by the EU. This facilitates seamless trade with many countries worldwide.

The Rise of Digital and AI Trading in Italy

As global financial markets digitize, Italy is also embracing innovative trading technologies, including:

1. Online Brokers and Retail Trading

Platforms like eToro, Plus500, FinecoBank, and DEGIRO are popular among Italian retail traders, offering access to:

- Italian stocks

- European and US equities

- ETFs and commodities

- Forex and cryptocurrencies

2. AI Trading Platforms

Artificial Intelligence (AI) is transforming Italy’s trading sector. AI-driven trading systems use big data, algorithms, and machine learning to make predictions and execute trades faster than human traders.

Advantages of AI Trading in Italy

- Speed and efficiency in trade execution

- Data-driven strategies with lower emotional bias

- 24/7 operations for global and crypto markets

Some Italy-based fintech startups and platforms are developing proprietary AI trading tools, while international platforms offer localized Italian support.

Forex and Cryptocurrency Trading in Italy

Forex Trading

Italy has a growing base of forex traders, and the activity is regulated under Consob (Commissione Nazionale per le Società e la Borsa). Top regulated brokers offering services in Italy include:

- IG Markets

- Saxo Bank

- XTB

- AvaTrade

EUR/USD remains the most traded pair among Italian forex traders.

Cryptocurrency in Italy

Italy has a progressive stance toward cryptocurrency. While not legal tender, crypto trading is legal and monitored by regulatory bodies. Key points:

- Crypto exchanges must register with Organismo Agenti e Mediatori (OAM)

- Capital gains from crypto are taxed above a threshold of €2,000 annually

- Popular platforms include Binance, Coinbase, and Bitpanda

Regulation and Compliance

Regulatory Authorities in Italy

- Consob: Oversees the securities market and protects investors

- Bank of Italy: Supervises banks and payment institutions

- OAM: Registers crypto providers and payment intermediaries

These regulators ensure that financial markets in Italy are stable, transparent, and fair.

MiFID II Compliance

As part of the EU, Italy adheres to MiFID II (Markets in Financial Instruments Directive), which enhances investor protection and transparency in trading.

Risks and Challenges in Italy Trading

Every market comes with risks. Italy is no exception, and traders or investors must be aware of the following:

1. Political Uncertainty

Italy’s political landscape can be volatile, which sometimes affects market sentiment and investor confidence.

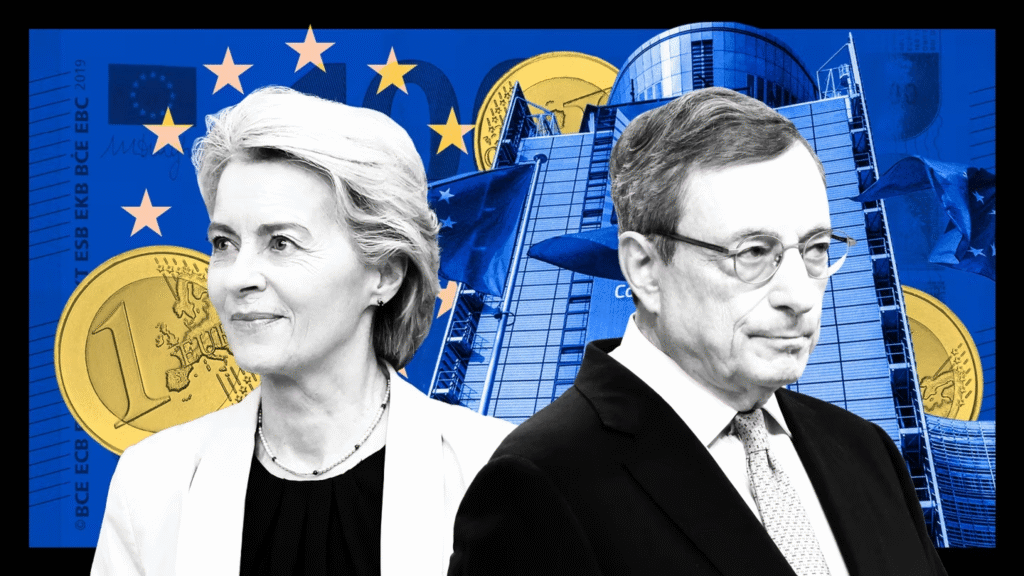

2. Economic Dependence on EU

Italy’s economy is closely tied to European monetary policy and trade flows. Changes in EU policy can directly impact Italian markets.

3. Market Volatility

Like other financial markets, Italian stocks and forex pairs can experience sharp fluctuations during economic or geopolitical events.

Opportunities for Foreign Investors

Italy offers several attractive opportunities for foreign investors and traders:

- Undervalued Stocks: Some sectors in Italy are still trading below European counterparts.

- Real Estate Market: Italy’s scenic towns and tourist hubs attract property investors.

- Green Energy and Innovation: Italy is investing in sustainability, offering opportunities in solar, wind, and AI industries.

Final Thoughts: Is Italy Trading Worth Exploring?

Whether you’re an experienced trader, an international investor, or a newcomer to European markets, Italy trading presents a world of opportunity. With its established stock exchange, growing digital finance sector, and strategic location in the Eurozone, Italy stands as a dynamic and diverse market. quantapptrader.com

While trading in Italy requires awareness of local regulations and market behavior, the country’s ongoing modernization and openness to innovation make it a compelling destination for both traditional and high-tech trading ventures.

Read More: Trading